The following is information from the Department for Business Enterprise and Regulatory Reform. It details the statutory minimums on the subject of redundancy, such would hopefully be improved upon through existing collective agreements on the subject for some staff. Others may not be as lucky.

Redundancy Payments: Ready Reckoner

Redundancy Payments: Ready ReckonerThe redundancy payment due to each employee under the statutory redundancy payment scheme depends on his or her age and length of service (up to twenty years). This determines the number of weeks pay due, which is then subject to a limit on weekly pay.

To calculate the number of weeks pay due, you should use the following amounts –

0.5 week’s pay for each full year of service where age during year less than 22

1.0 week’s pay for each full year of service where age during year is 22 or above, but less than 41

1.5 weeks’ pay for each full year of service where age during year is 41+

Ready Reckoner for calculating the number of weeks' pay due

Click on image to enlarge.Redundancy entitlement statutory rights: a guide for employeesIntroduction

Click on image to enlarge.Redundancy entitlement statutory rights: a guide for employeesIntroductionThis document gives general information about the redundancy payments scheme under the Employment Rights Act 1996 (referred to as 'the Act' in this document). It outlines provisions relating to time off to look for work or to make arrangements for training when facing redundancy and explains how a complaint is settled.

This document is not a complete or authoritative statement of the law; only the courts can provide that. If in doubt, you should seek your own independent legal advice.

The Redundancy Payments Offices can give you more information about entitlement in cases where an employer fails to pay a statutory redundancy payment for which an employee qualifies.

HELPLINEThere is a helpline to answer your questions. The number to ring is 0845 145 0004 (calls are charged at local rates).

Redundancy paymentsWhen is a redundancy payment due?Your employer must give you a lump-sum payment if:

you are made redundant;

you have at least two years continuous service; and

you meet the other conditions set out in this document.

You may also be entitled to other - non-statutory - payments if this has been agreed in your contract of employment.

* - In 2005 the Government looked at whether the statutory redundancy payments scheme would be compliant with the Age strand of the Employment Directive and concluded that the age bands are objectively justified. Evidence the Government has gathered demonstrates that younger, prime age and older workers fall into three distinct economic categories, with older workers facing a particularly difficult position in the employment market. Young workers tend not to be out of work for long, and see only a small fall in pay when switching jobs. Older workers are much more likely to become long-term unemployed, and to experience a substantial fall in pay when finding a new job. Prime age workers fall into the middle. The Government believes that it is sensible for the level of support provided through the scheme to reflect these three categories. However the Government concluded that the upper and lower age limits in the scheme could not be justified and under The Employment Equality (Age) Regulations 2006, the lower age limit of 18, the upper age limit of 65 and the taper at 64 will not apply to employees dismissed on or after 1 October 2006.

Who can qualify?You will receive payment only if you are an employee working under a contract of employment. Self-employed people and members of a partnership do not qualify under the Act though they may have separate contractual agreements.

Directors and other office holders may be employees if they work under a contract of employment. They will not qualify if they do not work under a contract of employment.

Contracts of employment may be spoken or written and last for any length of time or be fixed. In law, employees generally have a contract as soon as they start work and by doing so prove that they accept the conditions offered by the employer.

For further details see: Contracts of employment: changes, breach of contract and deductions from wages.

A few groups of employees do not qualify for a statutory redundancy payment. See Employees who may not be entitled to a redundancy payment

What 'dismissal' means

In general, to be due a payment, you must have been dismissed by your employer rather than have resigned and the reason for dismissal must have been redundancy.

If you are laid off (that is, you receive no wages) or put on short time (that is, you receive less than half a week's pay) for four weeks in a row or six weeks out of 13 weeks, you may also claim a redundancy payment without waiting to be dismissed for redundancy. You must make your claim in writing to your employer, who may refuse to pay if he or she believes normal working is likely to return within four weeks.

If you are on a fixed-term contract and it ends without being renewed, this counts as a dismissal and you may be due a redundancy payment.

If your employer says that redundancies will be needed and asks for volunteers you will qualify for a payment if you volunteer, as long as your employer actually dismisses you.

If your employer changes in circumstances covered by the Transfer of Undertakings (Protection of Employment) Regulations 2006, your contract of employment will be transferred automatically to the new employer. You have the right to tell the new or previous employer that you do not want to be transferred. However, this will be treated as a resignation, and you will not be entitled to a redundancy payment. The document A guide to the 2006 TUPE Regulations for employees, employers and representatives explains the Regulations.

If you have been given notice of redundancy, you may leave early by agreement with the employer and still qualify for payment. But the minimum period of notice which the employer has to give (by contract or by law) must have started by the time you give your notice.

What 'redundancy' meansYou will be entitled to a payment under the Act only if the reason for your dismissal is redundancy. This means that your dismissal must be caused by your employer's need to reduce his or her workforce. Redundancy may happen because a work place is closing down, or because fewer employees are (or are expected to be) needed for work of a particular kind. Normally your job must have disappeared. It is not redundancy if your employer immediately takes on a direct replacement for you. But it will not matter if your employer is recruiting more workers for work of a different kind, or in another location (unless you were required by contract to move to the new location).

If you are dismissed because of a need to reduce the work force, and one of the remaining employees moves into your job, you will still qualify for a redundancy payment so long as no vacancy exists in the area (type of work and location) where you worked.

General rules on length of serviceYou must generally have at least two years' continuous service with your employer to qualify for a payment. The rules on length of continuous service are described briefly in the What are the payments? section and in more detail in Continuous employment and a week's pay: rules for calculation

If you are offered a new jobYou may well not be entitled to a payment if you are offered a new job with the same employer, an associated employer or an employer who takes over the business. But if the new job is with the same or an associated employer you will only lose the redundancy payment only if the new job is offered before your old employment contract expires, and starts within four weeks.

If you are offered a new job in this way you can put off the decision whether or not to accept it for a four-week trial period. Or if you need retraining, the trial period may be extended beyond four weeks by written agreement between you and your employer. If at the end of the trial period you are still in the job, you will be considered to have accepted it.

If the new job is not a suitable alternative to the old one (because of differences in capacity, location or terms and conditions of the contract of employment) and you turn it down before the end of the trial period, you will be considered to have been redundant from the date your original employment ended. But if you refuse an offer of a job that is a suitable alternative without a good reason, you will not be entitled to a redundancy payment.

Disputes about paymentsIf you and your employer disagree about whether or not you should receive a redundancy payment, or about the amount you should receive, an employment tribunal can decide.

What are the payments?The amount of your lump-sum redundancy payment depends on:

how long you have been continuously employed by your employer;

how your years of continuous service relate to a particular age band; and

your weekly pay, up to a legal limit.

The amount of redundancy pay will be calculated as –

0.5 week’s pay for each full year of service where age during year less than 22

1.0 week’s pay for each full year of service where age during year is 22 or above, but less than 41

1.5 weeks’ pay for each full year of service where age during year is 41+

How to work out your length of serviceThe maximum number of years continuous service that can be counted for statutory redundancy payments purposes is 20. Length of continuous service is counted backwards from the 'relevant date'. This is generally the date on which the notice given to you ends. But if your employer gives you less than the legal minimum notice, the extra notice which you should have been given is added on. If under your contract of employment you were entitled to a longer period of notice, and you received this notice but did not work it, the date up to which your continuous service is counted may be later still.

Certain absences - for example, caused by sickness, pregnancy or temporary shortage of work - can count towards continuous service even if your contract of employment was suspended.

When working out your continuous service for a redundancy payment remember that days lost through industrial disputes do not count (although they do not actually break the continuous service). Any days you were on strike will be taken away from your total length of service.

If you are not sure, see Continuous employment and a week's pay: rules for calculation.

What a 'week's pay' meansThe amount of a week's pay to be taken into account is the amount you are entitled to under the terms of your contract of employment on the 'calculation date'.

The calculation date for your redundancy payment will generally be one of the following:

The date you were given the minimum notice required by law. This notice is usually one week for each year of service up to a maximum of 12 weeks.

If the notice you received was longer than this minimum, the date on which minimum notice would have had to have been given to end your employment on the same day as it actually ended.

The date the job ended, if you were not given notice or were not given enough notice.

If you had normal working hours and your pay did not change, for example with the amount of work you did, your week's pay is simply your basic weekly wage or salary. Overtime earnings are not included unless overtime was part of your normal working hours.

If your earnings changed from one week to another because of piecework or productivity bonus arrangements, your week's pay is worked out by multiplying the number of hours you normally worked in a week by your average hourly earnings over the 12 complete weeks of work before the calculation date. Only hours actually worked are taken into account. If the hours used in the calculation include hours outside normal working hours and paid at higher rates, the higher rate is ignored and the hours are worked out at the normal basic rate.

If your normal working hours varied from week to week because of shift work, and your earnings varied as a result, a similar calculation is done but the average hourly earnings are multiplied by the average weekly hours over the same 12 weeks. If you had no fixed working hours, your week's pay will be your average weekly earnings in the 12 weeks before the calculation date.

There is a limit on the amount of a week's pay that can be taken into account in working out your entitlement. The limit changes annually in line with the retail prices index (up or down) as appropriate. For details of current limits on payments, see the document Limits on payments - Guidance. The weekly limit was £330. But from the 2nd February 2009 the weekly limit was increased to £350.

What if my employer cannot pay?If your employer is insolvent, we will pay you and claim back the payment from the assets of the business. Ask your employer's representative (for example: liquidator, receiver or trustee) for a claim form "RP1". Fill it in as soon as possible after your employment has ended and send it to the Redundancy Payments Office.

How to claim a payment: time limitsUnder the Act, your employer must make the payment when or soon after you are dismissed. There is no need for you to make a claim unless your employer does not pay or says that you are not entitled to a payment. If this happens, you should write to your employer asking for payment or take the matter to an employment tribunal, or both. You must act within six months of the date your employment ended.

If you do not make a written claim, or do not apply to an employment tribunal within six months, you may lose the right to a payment. But a tribunal will still have the power to decide that you should receive a payment if you take action within a further six months.

If your employer is declared insolvent, or cannot or refuses to pay, and you have done everything you can to get your payment, you can apply to us for a direct payment from the National Insurance Fund. But you must have applied in writing to your employer for a payment within six months of the date your employment ended, or applied successfully to an employment tribunal within the six months after that.

Your pensionPensions may not be offset against statutory redundancy payments made to employees dismissed on or after 1 October 2006.

Tax

You will not pay income tax on a statutory redundancy payment though other redundancy payments you receive from your employer may be taxable - see Inland Revenue leaflet Redundancy factsheet. Normally your employer may set the payments against tax as business expense (for further details, see the Inspectors manual - or after mid-2003 the Business income manual - in the Publications section of the HM Revenue and Customs (formerly Inland Revenue) website.

Jobseeker’s AllowanceA statutory redundancy payment will have no effect on any entitlement you may have to contribution-based Jobseeker's Allowance.

If you die, or your employer diesIf your employer is the only owner of the business and the business stops trading because he or she dies, his or her personal representative is responsible for any redundancy payments due. If the representative carries on the business and offers you a new job which is acceptable and starts within eight weeks, you will not be entitled to a redundancy payment. If you die before you receive your redundancy payment, the payment will be made to your personal representative. There are also special rules about what happens if you or your employer dies while you are laid off or on short time. The Redundancy Payments Office can give more information.

Employees who may not be entitled to a redundancy payment

The following categories of employees have no right to a redundancy payment under the Act:

Members of the Armed Forces.

House of Lords and House of Commons staff.

Apprentices whose service ends at the end of the apprenticeship contract.

Employees at the end of a fixed term contract which was agreed, renewed or extended before 1 October 2002 and lasts at least two years where they have already given written agreement to waive their entitlement to a redundancy payment at the end of the contract. Any waivers inserted into contracts agreed, renewed or extended after 1 October 2002 will not be valid and fixed-term employees will have a right to statutory redundancy payments if they have been continuously employed for two years or more and are made redundant - see Fixed term work: a guide to the regulations.

Domestic servants working in a private home who are members of the employer's immediate close family.

Share fishermen paid only by a share in the proceeds of the catch.

Crown servants or employees in a public office.

Employees of the Government of an overseas territory.

Employment in Northern Ireland for the same employer, an associated employer or an employer who takes over the business can be counted, as long as there was no break in service. Employment in Great Britain can count towards a redundancy payment under Northern Ireland law.

Applying to an employment tribunalIf you disagree with your employer about your entitlement to a redundancy payment, you can take the matter to an employment tribunal. You can do this at any time. But you may lose your right to a payment if you do not take certain steps within six months of the day your job ends, or the date any new job ends with your employer, an associated employer or an employer who takes over the business. If you have made a written claim to your employer or contacted an employment tribunal within six months, you cannot lose your right to a payment because of delay.

If you do not take any of the steps mentioned above within the first six months, but take one of those steps within the following six months, the employment tribunal may still decide that you should receive a payment. They will consider the reason for the delay and all the circumstances.

If you want to apply to a tribunal please ask at a Jobcentre Plus office for a form IT1 and leaflet or phone the Helpline 0845 145 0004.

When you apply to an employment tribunal, you should name your employer as 'respondent' on the application form. If your employer is insolvent, you should add the words 'in receivership’ or in liquidation’ to your employer's name as appropriate. You should give the name and address of the receiver or liquidator separately, if you know it.

If the tribunal awards you a redundancy payment, but you do not receive it, ask the Redundancy Payments Office for advice.

Time off for job hunting or to arrange training when facing redundancyAn employee who is given notice of dismissal because of redundancy is entitled to reasonable time off with pay during working hours to look for another job or make arrangements for training for future employment. The time off must be allowed during the period of notice.

Employees are entitled to time off in this way only if they have had two years' continuous employment with their employer on the date their notice expires or the date when the statutory minimum period of notice due under the legislation expires, whichever is the later.

For an explanation of the meaning of "continuous employment", or in case of difficulty in deciding on the length of continuous employment, see Continuous employment and a week's pay: rules for calculation.

If the business or part of the business has been transferred from one employer to another, see A guide to the 2006 TUPE Regulations.

People not covered by the provisionsCertain workers are not covered, either because they are not employees, or because they are already covered by other arrangements, or because their terms and conditions of employment make the application of the provisions inappropriate. These are:

anyone who is not an employee an independent contractor or freelance agent;

members of the police service and armed forces;

masters and crew members engaged in share fishing who are paid solely by a share in the profits or gross earnings of a fishing vessel;

merchant seamen.

Amount of time off

An employer should allow the employee reasonable time off. The legislation does not specify what is reasonable since this will vary with the differing circumstances of employers and employees. Some employees may need only to attend one interview or make one visit. Others may have to make a number of visits, some of which may involve travelling some distance.

Payment for time offEmployees should be paid the appropriate hourly rate for the period of absence from work but an employer does not have to pay more than two-fifths of a week's pay, regardless of the length of time off allowed. This is arrived at by dividing the amount of a week's pay by the number of normal working hours in the week. The method of calculation is similar to that used for computing redundancy payments. The week's pay is calculated by reference to a date known as 'the calculation date'. In computing pay for time off to look for work or arrange training, this date is the one on which notice was given by the employer.

An employer does not have to pay more than once for the same period. Any payment already made under an employee's contract of employment for a period of time off to look for work will be offset against the employer's liability under the provisions. If payment has been made by an employer for time off to look for work under the provisions, this will reduce any liability under the contract of employment.

Making a complaintEmployees who are unreasonably refused time off by their employers have a right to be paid the amount they would have been entitled to receive had they been allowed time off, subject to a limit of two-fifths of a week's pay. An employee can complain to an employment tribunal in cases where the employer refuses either to allow time off or to make the appropriate payment. A complaint should be made within three months of the date on which time off should have been allowed, but employment tribunals have discretion to accept complaints made after the three-month period if they consider that it was not reasonably practicable for the employee to make the complaint earlier.

An employee who wishes to complain to a tribunal should obtain a form IT1 or IT1 (Scot) in Scotland which is included in the explanatory leaflet How to apply to an Employment Tribunal, available from any Jobcentre Plus office and Citizens Advice Bureau.

ConciliationThe tribunal will send a copy of the completed form to the Advisory, Conciliation and Arbitration Service (Acas) who may attempt to get both sides to settle the complaint without the need for a tribunal hearing.

The services of an Acas conciliator will also be available in the absence of a formal complaint on form IT1, at the request of the employee or employer. In such a case the employee or employer can get in touch with a conciliator through an office of Acas. Information given to conciliators in the course of their duties will be treated as confidential. It may not be divulged to the tribunal without the consent of the person who gave it.

Tribunal hearingIf no settlement is reached the tribunal will hear the case. Tribunal hearings are conducted informally. Both parties should attend and may claim travelling and other expenses, including loss of earnings. The parties can be represented by anyone they wish, including a representative of a trade union or employer's association. It is not necessary to engage a solicitor, but there is no objection to either party doing so if legal representation is preferred. Tribunal proceedings are conducted in such a way as to make it easy for individuals to conduct their own case if they wish.

RemedyWhere the tribunal is satisfied that a complaint is justified, it will order the employer to pay the employee the money, or the balance of the money, due.

HELPLINEA helpline is available to answer any of your queries, no matter where in England, Scotland or Wales your firm is based. The number to ring is 0845 145 0004.

Once your claim has been sent to the appropriate Redundancy Payments Office above you can phone the officer dealing with your case at that office.

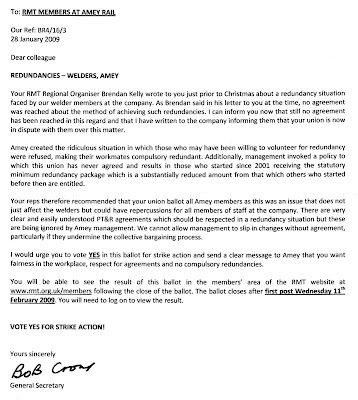

Statutory redundundancy matrix. Click on image to enlarge.

Statutory redundundancy matrix. Click on image to enlarge. Statutory redundundancy matrix. Click on image to enlarge.

Statutory redundundancy matrix. Click on image to enlarge.